Here are some common questions employers and their employees have about accessing W-2s online in ViewMyPaycheck.

- Employers prepare employee W-2s in QuickBooks and then upload the W-2 info to Intuit's servers.

- Employees get a notification email from the employer that lets them sign up and/or sign in to ViewMyPaycheck — the website that enables online access to W-2s.

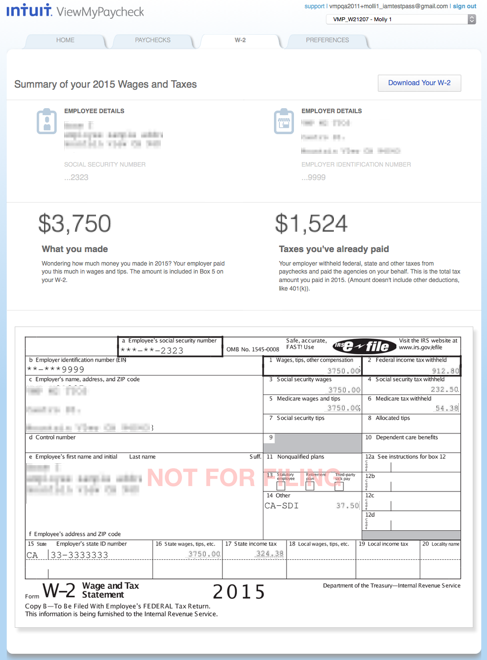

- Employees who sign in to ViewMyPaycheck to access their W-2 online will see something like this:

In ViewMyPaycheck, employees can:

- See a summary of W-2 info

- See a copy of their official W-2

- Print their official W-2

- Start their personal tax return in Intuit TurboTax

Absolutely! Your security is very important to us.

Intuit uses industry-standard methods to send the W-2 info electronically to Intuit's firewall-protected servers.

Also, to view your W-2 online, you must sign in with a unique user ID and password and provide some additional info to verify who you are.

Yes. You must use one of the following browsers to view your W-2 online in ViewMyPaycheck.

- Microsoft Internet Explorer (IE) 10 or later

- Google Chrome

- Mozilla FireFox

- Apple Safari

Note: Each link opens browser in a separate window or tab.

Your employer will let you know by email when you can access your W-2s online.

Then you just need to provide some information that verifies who you are and create a secure account that only you can access. You only need to do this once. As soon as you do, you can view your own W-2 anytime you want — 24/7.

Just follow these steps:

- Click the link in the notification email from your employer: https://paychecks.intuit.com/?source=qbw2email.

- Click Sign Up. When prompted, answer the security questions.

- Follow the onscreen instructions to create an Intuit account. Then sign in.

Note: If you already have an Intuit account, use that one to sign in. - View and, if you'd like, print your W-2.

That's it!

If you don't see the W-2 tab after you sign in to ViewMyPaycheck, most likely your employer hasn't uploaded your W-2s yet. Please contact your employer to confirm if W-2s have been uploaded.

Are you an employer? If you've already uploaded W-2s, and it's between late December through January, it can take 24-48 hours for employees to see them in ViewMyPaycheck. This is due to a high volume of customer uploads at this time of year.

If it has been longer than 48 hours there might be a system issue. Here's some more info:

- Do other employees have the same problem? If yes, there was most likely an issue with the W-2 upload. Try again — upload your W-2s one more time and wait 48 hours for them to appear. If the W-2s are still not visible, contact ViewMyPaycheck Support for additional help.

- Is the issue only happening for a single employee? If yes, it is most likely a data problem for that individual employee. Contact ViewMyPaycheck Support for additional help.

Yes. Just click Download Your W-2 to open your W-2 in a PDF format and the use the PDF print function to print a copy of your W-2.

Install Adobe Acrobat Reader (it's free!)

Important! W-2s that are printed from ViewMyPaycheck or printed from TurboTax Online are not considered official copies. Employers must send employees a paper copy of the official W-2.

W-2s that are printed from ViewMyPaycheck or printed from TurboTax Online are not considered official copies. Employers must send employees a paper copy of the official W-2.

Contact your employer to find out how and when you'll get your 2016 W-2.

Yes! Just click Get started now to open Intuit TurboTax — Intuit's tax preparation software.

If you choose to use TurboTax to prepare your personal tax return, you can import your W-2 info so you don't need to enter it by hand.

No, prior year W-2s will not be available in ViewMyPaycheck. Employees will need to contact the employer for information about W-2s from prior years.