(Or click the Employees tab.)

Enter the garnishment details. Make sure to refer to the court or levy order when you define the garnishment details in your payroll account.

| Field | What to enter |

| Description | This description appears on reports and pay stubs. It's a good idea to enter both the employee and agency names so that you can easily recognize which agency is owed the garnishment. |

| Amount Requested | Applies to Child/Spousal Support orders only. If allowed by the order, include any administrative fee you add. |

| Maximum % of disposable income |

Applies to Child/Spousal Support orders only. The corresponding language in the order is "The total withheld amount, including your fee, cannot exceed __ % of the employee's/obligor's aggregate disposable weekly earnings." |

| Alternate Garnishment Cap | Applies to Other Garnishment type only. Look for a withholding limit or cap on the order you received. The total garnishment cap must include any administrative fee you add. |

| Amount Exempt | Applies to Federal Tax Levy orders only. Enter the amount that appears in the table included in the order. |

| Exempt adjustment |

This field only appears if you've contacted us about a special situation that requires reducing or increasing the amount of employee income that's exempt from the garnishment. When you contact us, we'll explain what to enter. |

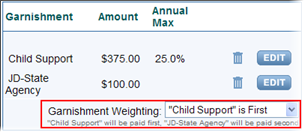

If this is a second garnishment for this employee, click the Garnishment Weighting drop-down arrow and select the priority for payment of the garnishments. Make sure that you refer to the court or levy order when you select the weighting.

Intuit Online Payroll figures out the maximum that may be withheld from the employee per paycheck and divides the money across the various garnishments depending on the weighting option you select:

- Named Garnishment is First: The named garnishment will be satisfied on each paycheck before any other garnishment.

- Pay both garnishments equally: Intuit Online Payroll will figure out the maximum that may be withheld and will apportion the money equally to each garnishment.

- Pay pro-rated amounts for each garnishment: Intuit Online Payroll will figure out the maximum that may be withheld and will apportion the money equally to each garnishment according to the ratio of the amounts of the garnishments. For example, if one garnishment is for $500 and the other is for $700, the ratio is 5 to 7.