- Choose whether you want to adjust the paycheck for salaried employees.

Why?

You may want to pay employees a partial salary if they start or terminate employment, or were on unpaid leave during the pay period.

For example, if the pay period is Nov 16 - 30, but an employee's last day of work is on Nov 22, you'll probably want to choose No, I want to pay a different amount and adjust the paycheck accordingly.

- Select the deductions to include on this check.

Why?

Your employees already have deductions set up for their regular paychecks. They may also want some or all of those deductions applied to unscheduled checks, so as to accrue deductions on all the money they earn from you.

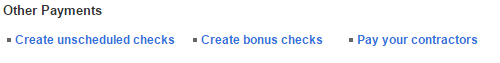

When you create unscheduled checks, we give you the option of applying some or all of an employee's deductions to the checks.

You can create unscheduled checks for the current pay period all the way back to pay periods dating 6 months ago. You can't create a check with a past date.

The only check dates that are available are dates that fall after your last check date and before your next payday. We do this to keep your payroll taxes error-free.