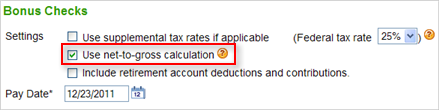

When you want to create a bonus check for a certain take-home (or net) amount, such as $100.00 or $500.00, you may want us to calculate the gross amount for you so taxes and deductions are calculated and included on the check.

You tell us what you'd like the take-home bonus to be, and we'll figure out how much the check needs to be. For example, if you want to give your employee a take-home bonus of $500, we'll calculate the total amount of the check before taxes.

You can't use net-to-gross bonus calculation together with any deductions

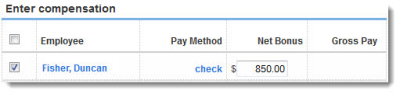

Let's say you want to give your employee a $500.00 bonus check, but the employee's profile is set up to withhold an additional $350.00 in federal taxes each paycheck.

To ensure that the net pay on the bonus check is exactly $500.00, add the $350.00 to the amount in the Net Bonus field, like this:

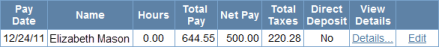

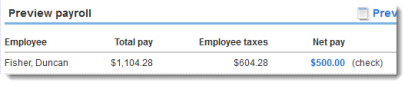

and we'll calculate the correct amount on the check, like this:

SetupDoneStill have questions? Search Payroll Help

ContactUsStill stuck? Contact us