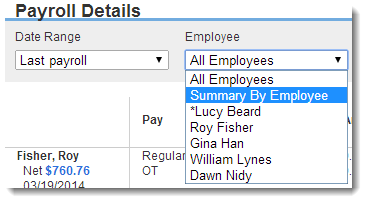

The Payroll Details Summary By Employee report offers a breakdown of total wages and deductions by employee for a specific period of time. To run this report:

- Click the Reports tab.

- Select the Payroll Details report.

- Adjust the date range or the report options to customize the results.

- Click the Employee drop-down arrow, and then select Summary by Employee.

- Click Run Report.