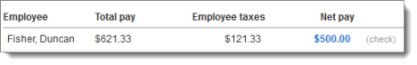

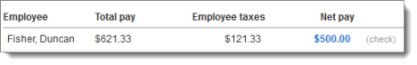

You tell us what you'd like the take-home bonus to be, and we'll figure out how much the check needs to be. For example, if you want to give your employee a take-home bonus of $500, we'll calculate the total amount of the check before taxes.

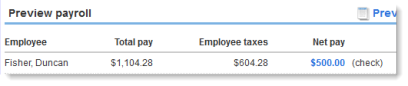

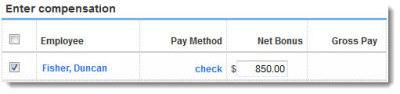

Let's say you want to give your employee a $500.00 bonus check, but the employee's profile is set up to withhold an additional $350.00 in federal taxes each paycheck.

To ensure that the net pay on the bonus check is exactly $500.00, add the $350.00 to the amount in the Net Bonus field, like this:

and we'll calculate the correct amount on the check, like this: