Here are answers to some common questions about allowing employees to upload their W-2 data to Intuit TurboTax:

Absolutely! Intuit uses industry-standard methods to securely send the W-2 information electronically to Intuit's firewall-protected servers. The information is sent only when requested by the employee. Each employee has access only to his or her own W-2 information through a unique individual login from Intuit TurboTax.

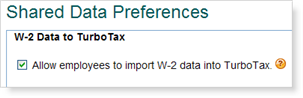

When the Allow employees to import W-2 data into TurboTax preference is enabled, the following happens:

- You print your employee W-2s in Online Payroll. That's it.

- Then, when employees prepare their personal tax returns in Intuit TurboTax, they're prompted to enter the company federal Employer Identification Number (EIN) listed in Box b on their printed W-2 form.

Note: To confirm their identity, they're also prompted for their social security number (SSN) and the Box 1 wages from their printed W-2 form. - TurboTax searches for the company's federal EIN. If the preference for the company is on, then TurboTax imports the W-2 information into the employee's TurboTax account.

Important: If the preference is turned off in Online Payroll, TurboTax doesn't import the employee W-2 information and instead displays a message that says the employee must enter the W-2 information manually.

Allowing employees to upload their W-2 information to TurboTax means that employees who choose to use TurboTax can import their W-2 information.

Of course, employees can complete their tax returns however they want. So, if they don't want to use TurboTax, they can enter their W-2 information manually from the printed copy of their W-2 forms.

Yes. Allowing employees to import their W-2 information into Intuit TurboTax does not replace the requirement to provide your employees with print copies of their W-2 forms. It just makes it easier for employees who use TurboTax to complete their tax returns since they don't have to enter their W-2 information into TurboTax — they import it.

By default, this feature is enabled (turned on) for your company. If you want to turn it off, you can deselect the preference setting in your Online Payroll account.