Year end: Direct deposit submission and payroll deadlines

Year end: Direct deposit submission and payroll deadlines Year end: Direct deposit submission and payroll deadlines

Year end: Direct deposit submission and payroll deadlinesWhen you run a payroll that includes direct deposit paychecks, keep your eye on submission dates to avoid penalties— especially around the holidays and year end.

To avoid nasty penalties and fees (as well as follow the principle of constructive receipt), be sure that wages dated for 2016 are received in 2016 and wages dated for 2017 are received in 2017.

Constructive receipt is an accounting term that determines when income is taken and received.

According to the IRS (Publication 538), income is constructively received when an amount is credited to an employee's account or made available to an employee "without restriction."

For example, you hand your employee "Joe" a printed paycheck — he has received the paycheck, but the amount isn't credited to "Joe's" account until he deposits the paycheck and the bank processes the transaction.

This is especially important at the end of the year when employee wages need to be recorded and reported to the tax agencies as income in the correct year. If a paycheck is dated December 2016, that's the year the employee is considered to have received the income.

Sometimes, however, a paycheck reflects a pay period that includes the last week in December 2016, and the first week in January 2017. If the paycheck is dated in January 2017, all of the income is considered to have been received in 2017 and should be reported as 2017 income.

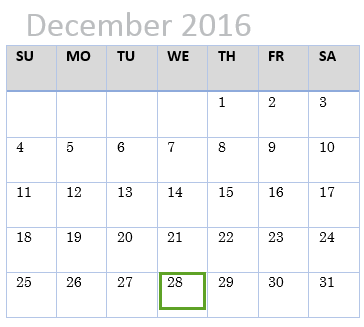

Wed Dec 28, 2016 (5 pm PT) is the last day you can submit your 2016 direct deposit paychecks. (Employees will be paid on Fri Dec 30, 2016.)

Create direct deposit bonus checks 5 business days prior to the direct deposit deadline date to avoid any delays in processing.

Check the direct deposit status. If we haven't started processing the direct deposit paychecks, you can give out handwritten checks along with printed pay stubs. If we have started processing the direct deposit paychecks,

For employees who receive handwritten or printed paychecks, you can still give your employees their 2016 paychecks on Sat Dec 31, 2016.

SetupDoneStill have questions? Search Payroll Help

ContactUsStill stuck? Contact us