Taxes: What if I manually paid a tax?

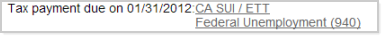

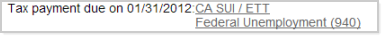

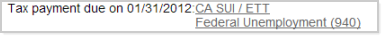

Maybe there's an item on your To Do list called Tax payment due on (a date), with a link to one or more tax types.

If you paid it yourself before you started using Intuit Online Payroll, here's how to get it off your To Do list:

- Make a note of the payment due date and the tax type in the To Do item.

-

Go here.

(Or choose Taxes & Forms and then Prior Tax History.)

Choose > Taxes & Forms and then Prior Tax History.

- Click Add Payment.

- Select the Tax Type that corresponds to the one listed on the To Do item. The page changes to display the appropriate tax items.

- For Liability Period, choose the quarter when the liability was incurred; that is, the quarter in which the payrolls were run.

- Enter the date you made your tax payment.

- Enter the amounts for each Tax Item, and then click OK.

- If you have another tax payment to add, click Add Payment. If you need to edit a payment you added, click Details on its row.

- Go back to the To Do page to make sure the To Do item was removed. If not, repeat the steps above, and edit the payment you added. Check to make sure you assigned the correct Tax Type and Liability Period, for example.

Why is this important to do?

We use information about tax payments you have already made this year:

- to calculate your current tax liability

- to complete tax forms

If you have already made tax payments this year but do not record this tax payment history, we will:

- not be able to properly calculate your current tax liability

- not be able to properly complete quarterly and annual forms that require summary information for a given tax period

ContactUsStill stuck? Contact us